The silver market is projected to experience steady demand and moderate price gains through 2025, supported by rising industrial uses—especially in solar energy—and constrained supply. The outlook spans key demand drivers like solar and electronics, evolving investment trends, and supply-side constraints, offering nuanced insight for investors and industry watchers.

2025 Silver Market: Core Demand Shifts

The metal’s industrial usage—especially in solar photovoltaics and electronics—is expected to lead the charge in demand growth. Solar demand continues to surge as governments push renewable energy adoption. At the same time, industrial applications remain resilient, with modest expansion in electronics, EVs, and 5G devices.

Meanwhile, investor interest appears mixed. ETFs have seen modest inflows, but retail interest looks patchy, dampened by higher interest rates and focus on other safe havens. All told, demand dynamics point toward a stable but growing consumption picture.

Supply Constraints and Cost Pressures

Silver production is not keeping pace with demand upticks. Many major mines are aging, output improvements are incremental, and exploration remains limited. With mining companies cautious on new projects, global supply growth is likely flat.

At the same time, production costs remain elevated, especially in jurisdictions with tougher regulatory or environmental norms. This combination of stagnating supply and sustained costs creates a subtle upward pressure on silver prices, even without explosive demand spikes.

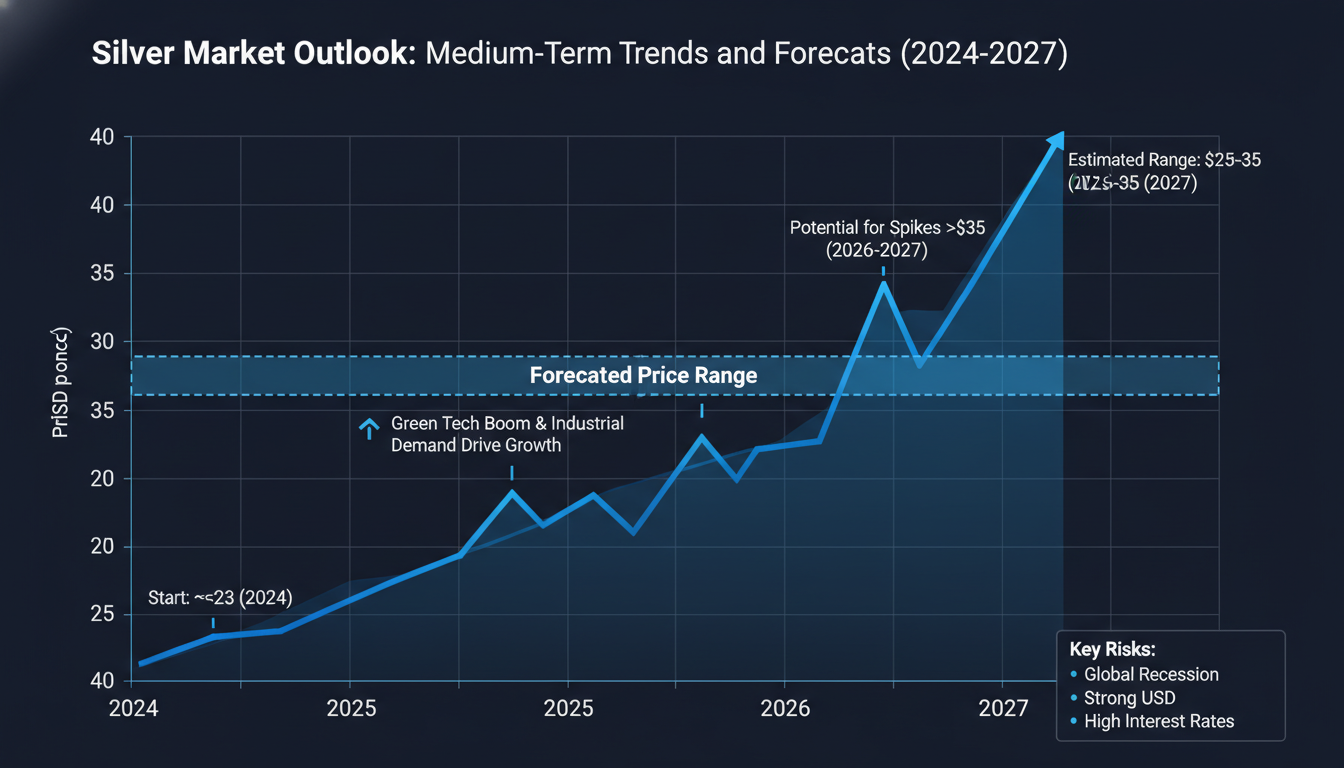

Price Forecast Snapshot

Current trends suggest moderate price appreciation rather than sharp gains. Analysts generally forecast silver prices moving into the mid‑$20 range per ounce by late 2025, assuming continued strength in solar and sustained industrial use.

That said, bullish scenarios—including strong green stimulus or a spike in industrial use—could push prices into the upper $20s. On the flip side, weaker investor sentiment or supply surprises might keep price gains modest.

“Solar energy is shaping up to be one of the most consistent drivers of silver demand over the next few years,” comments a mining industry analyst, reflecting the broader shift toward renewables.

What’s Driving Demand Under the Surface?

Solar Sector as Growth Anchor

Renewable energy mandates are fueling massive solar installations, and silver is a key input in photovoltaic cells. As governments and corporations invest in clean energy infrastructure, silver demand should continue rising.

Electronics, EVs, and 5G Tailwinds

Electronics makers rely on silver for conductivity, even in tiny amounts. Growing adoption of electric vehicles and 5G networks adds to that baseline consumption, though gains are gradual rather than exponential.

Investor Behavior in a Volatile Market

Gold often dominates the “safe haven” narrative, but silver benefits too when risk appetite grows. However, with central banks leaning hawkish and equities relatively stable, silver’s investment flows remain cautious.

Supply Picture: Why It Matters

Aging Mines and Limited Capex

Many existing silver mines are mature. Without new developments, capacity plateaus. Mining companies are conservative—exploration budgets and new project launches are modest.

Regulatory & Environmental Pressures

Mining in many regions is becoming more expensive due to tougher regulations. Environmental standards and permitting delays introduce uncertainty and slow output.

Secondary Supply Still Relevant

Recycling and scrap continue to fill gaps, especially in industrial sectors. But it’s unlikely to offset supply shortfalls if demand rises meaningfully.

Price Drivers in Play

The silver price depends on a balance of supply tightness and demand expansion. Key influences include:

- Renewable energy policies globally

- Investor sentiment, especially around inflation or recession fears

- Mine production levels and new project announcements

- Cost structures across key mining regions

These factors weave into a scenario where price volatility could spike, though steady upside seems most likely barring major shocks.

Strategic Implications for Stakeholders

- Industrial Buyers: Locking in contracts now may hedge against mid‑2025 price gains.

- Investors: A slowly rising price trend makes physical silver or ETFs viable—but stay cautious on leverage.

- Miners: The supply shortfall signals opportunity, though capital and permitting remain barriers.

Conclusion

Silver’s medium‑term outlook is one of steady, if unspectacular, upward momentum through 2025. Industrial demand—centered on solar energy—should drive growth. Meanwhile, supply constraints, aging mines, and modest investor flows reinforce price support. Unless macro shocks or policy shifts intervene, expect prices to trend modestly higher, likely settling in the mid‑$20s by late 2025.

FAQs

What’s pushing silver demand higher through 2025?

The solar power boom is the main driver, backed by steady use in electronics and emerging demand from EV and 5G sectors.

Will investor interest in silver grow alongside inflation concerns?

Maybe. Silver tends to benefit from safe-haven demand, but current higher interest rates and lower volatility may keep flows moderate.

Can supply catch up if demand surges suddenly?

Unlikely. New mining projects are few and far between, and regulatory hurdles make rapid output increases tough.

How high can silver prices go by the end of 2025?

A mid‑$20 range per ounce seems most plausible. Strong stimulus or industrial growth could push it higher, while supply or demand shocks might slow gains.

Should businesses consider hedging silver purchases now?

For many industrial buyers, yes. Forward contracts or allocations now may offer protection against mid‑2025 price increases.

Leave a comment