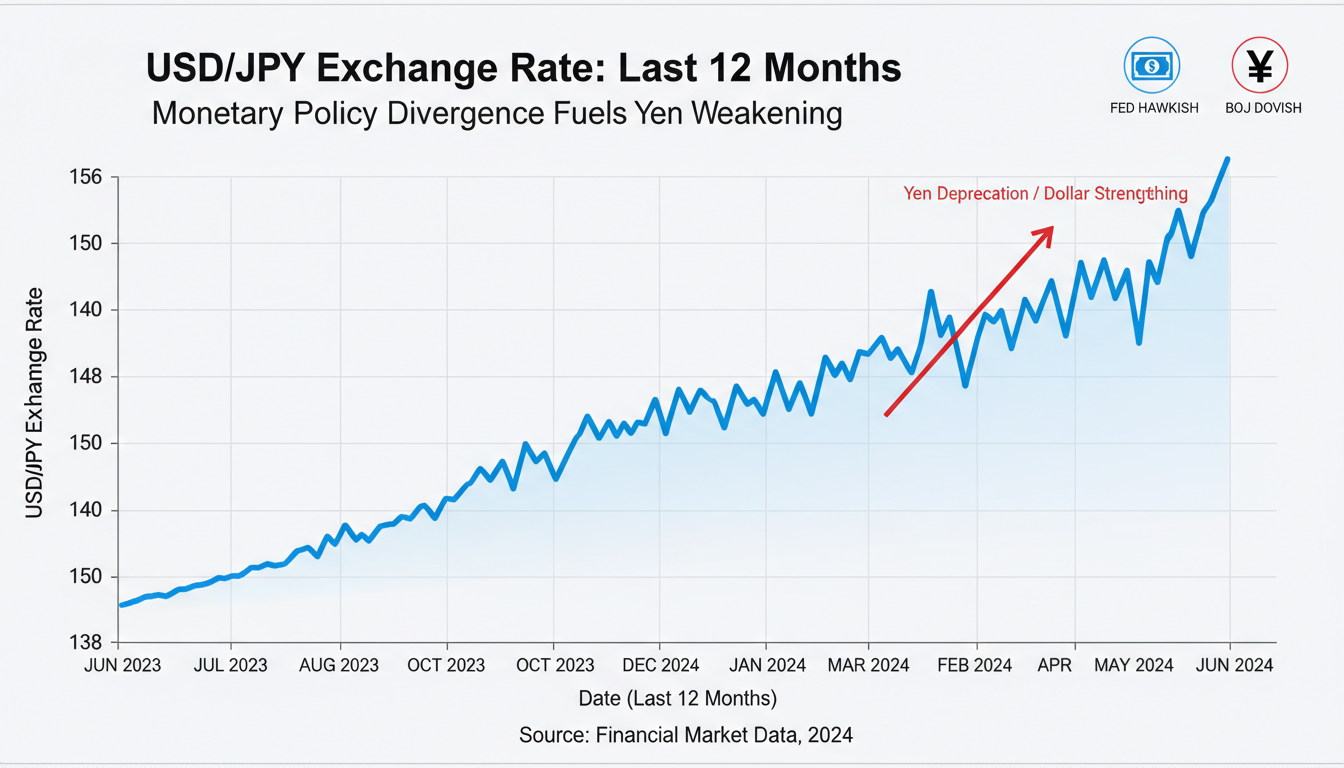

The dollar–yen outlook is shaped by policy divergence, economic performance, and risk sentiment. Right now, the pressing question: is the dollar set to strengthen or soften versus the yen? The answer lies in how U.S. Federal Reserve moves, Bank of Japan policy, Japan’s growth path, global risk appetite, and inflation dynamics all interplay. Simply put, unless there’s a dramatic shift, the dollar will likely stay firm—driven by Fed hawkishness and lingering uncertainty—while the yen remains under steady pressure from BOJ easing and mixed growth signals.

Economic Policy Divergence Driving the Move

Policy divergence is a key driver behind the dollar’s strength against the yen. The Federal Reserve has been gradually dialing back its rate hikes, but interest rates in the U.S. remain elevated compared to those in Japan.

Japan’s central bank, the Bank of Japan (BOJ), remains on a path of ultra-loose policy. Negative or near-zero interest rates and continued yield curve control have limited the yen’s appeal to global investors. At the same time, easy monetary policy in Japan and tight policy in the U.S. tends to attract capital out of yen and into dollar assets.

Beyond this, inflation trends reinforce the divide. U.S. inflation has cooled somewhat—but remains sticky—keeping the Fed cautious and markets expecting rates to remain higher for longer. Meanwhile, Japan continues to grapple with very low, even below-target, inflation. This means BOJ has little incentive to hike or shift to neutral policy.

Why it matters right now

- Interest rate gaps reward investors more in dollar assets.

- Capital flows continue toward U.S. markets.

- Policy signals from the Fed suggest a steady path, whereas the BOJ stays dovish.

All these reinforce pressure on the yen. In practice, unless Japan surprises with a shift in tone—or the U.S. signals rate cuts soon—the dollar likely stays firm.

Global Risk Sentiment and Safe-Haven Currency Play

The yen has traditionally been a safe-haven asset. In times of global risk-off, yen usually strengthens as investors flee to perceived safety. But that pattern has shifted recently.

Why the yen isn’t jumping as usual

- Japan’s yield curve control policy limits attractive yields, curbing demand.

- Better growth in other risk-off contexts has made other safe-haven assets like U.S. Treasuries or gold more appealing.

- Japan’s domestic structural issues moderate demand for yen.

On the other hand, when markets are risk-on, yen tends to fall further since it’s seen as a high-cost funding currency for carry trades. And with U.S. growth holding up, markets often favor dollar exposure.

“Currency pressure isn’t just about rates—it’s about where investors want to put their money, and right now the U.S. is the place.”

When risk sentiment is jittery, we still see only modest yen strength. In calmer or risk-positive phases, the yen weakens instead.

Inflation and Growth Contrast

Growth trajectories and inflation between the two economies are further tilting the scales.

United States

U.S. continues to show decent growth and job market resilience. Even with inflation easing, the labor and services sectors remain solid, providing cover for the Fed to keep rates elevated.

Japan

Japan’s growth remains fragile in parts. Domestic demand is sluggish, and export strength depends heavily on global cycles. Inflation lies stubbornly below target—despite recent upticks in energy price pass-through—signaling sustained need for accommodative policy.

This contrast feeds into investor expectations. If Japan were to see a meaningful rebound, investors might reconsider. But absent that, they continue favoring dollar assets.

Currency Market Mechanics and Interventions

Of course, currencies don’t move without friction. Japan has occasionally stepped in to prop up the yen when moves were extreme. But interventions are typically reactive and limited.

Intervention as a pressure valve

When the yen weakens sharply, authorities issue warnings, then move to buy yen in FX markets. These moves can arrest downward slides—temporarily. But if fundamentals continue to push dollar higher, these measures only delay the inevitable.

Another factor: market structure. Yen liquidity, especially at key levels, can fluctuate broadly. Automated systems and positioning can deepen moves in either direction. So, while intervention matters, it has to be heavy-handed and sustained to have lasting impact.

Real-World Example: Carry Trades and Yield Hunting

Investors often borrow in low-yielding currencies like yen and invest in higher-return assets—called carry trades. In the past decade, these strategies amplified yen sell-offs. Here’s why they matter now:

- With U.S. yields higher, carry remains profitable.

- Low Japanese rates make yen cheap funding.

- If growth or inflation stabilizes in U.S., the carry stays enticing.

Even a shift in mood—say, a minor positive surprise in U.S. data—can spur carry positions and further yen weakening.

Scenario Planning: What Could Change the Outlook?

Several scenarios could tilt the outlook:

-

BOJ policy shift

If BOJ drops yield curve control and hints at future hikes, yen might see reprieve. -

U.S. recession fears

Any signs of sharper slowdown could pressure U.S. rates lower, giving yen room to rally. -

Crisis event

Geopolitical tension or financial shock could revive yen’s safe-haven status. -

Market exhaustion

After prolonged dollar strength, positioning may flip on technicals and valuations.

Even one of these could alter the pressure dynamics—but markets would likely wait for clear evidence, not speculate.

Conclusion

Dollar–yen pressure stems from uneven policy, divergent growth, and investor behavior. The U.S. holds the upper hand with higher rates and resilient growth, while Japan’s low inflation and easing stance challenge the yen. Risk sentiment and carry flows add extra weight to this tilt. Unless Japan pivots or the U.S. stumbles, expect dollar strength to persist. Time to watch central bank signals closely—and stay ready for surprise moves.

FAQs

How does the interest rate gap affect dollar–yen?

Higher U.S. rates compared to Japan’s near-zero levels make dollar assets more attractive. This draws capital into dollars and keeps pressure on the yen.

Why doesn’t the yen strengthen during global market stress?

Despite its safe-haven label, the yen is held down by low yield and limited monetary policy flexibility, and other safe havens like Treasuries often draw more attention.

Can Japan’s central bank stop the yen from weakening?

Intervention can slow declines short-term, but without a policy shift or supporting fundamentals, it doesn’t guarantee a sustainable reversal.

What role do carry trades play in yen movements?

Carry trades amplify yen selling: investors borrow cheap yen to invest in higher-yield assets. Strong U.S. yields keep the strategy appealing, pressuring the yen.

Could unexpected U.S. weakness help the yen?

Yes. If U.S. growth hits a snag or rate cuts accelerate, yield differentials narrow, reducing incentive to hold dollars and giving yen some room to recover.

Leave a comment