Key Insights

- Cardano holds support at nearly $0.84 while eyeing a breakout above $1.

- Whale accumulation and institutional inflows are showing a rise in confidence in ADA.

- On-chain growth with over 112 million transactions supports long-term potential.

Cardano price has remained steady despite the mixed market signals from the charts and on-chain data. ADA was trading around the $0.86 price level when writing after gaining slight ground over the last 24 hours.

The token is down by more than 12% on the weekly chart. However, analysts believe that its structure is still constructive.

Whale Accumulation Supports Cardano’s Price

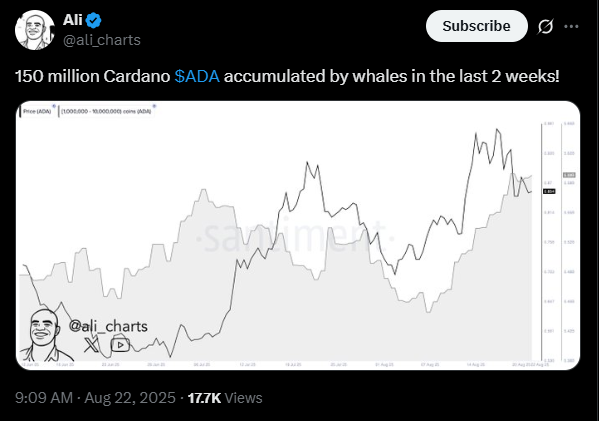

Whale activity and strong institutional inflows have been steadily adding to the debate. According to Ali Charts, more than 150 million ADA have been accumulated by large investors in the last two weeks.

These movements are often a signal that big players are setting up ahead of a rally. This means the current Cardano price zone is prompting the whales to act.

Historically, Whale accumulation tends to strengthen confidence in an asset and can be a major source of support during uncertainty.

This means that the ADA may stay stable at its current price level. If this happens, the whales could help absorb the sell pressure and set the tone for a move higher.

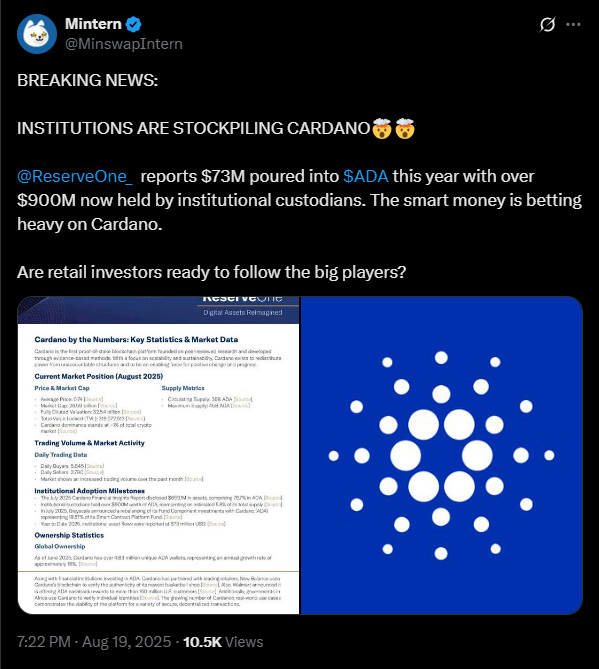

Institutional Inflows And Market Structure

More than retail and whale action, institutional interest in ADA has been on the rise as well. For example, insights from Mintern show inflows of around $73 million into ADA this year alone. Additionally, institutions now hold more than $900 million in custody.

Analysts believe institutions are attracted to liquidity, strong infrastructure, and long-term value. Cardano meets these requirements, and its transaction fees are some of the lowest in crypto.

The Cardano blockchain continues to process millions of transactions daily, and development activity has increased.

Cardano Price Patterns and Technical Setup

According to the charts, the asset’s price is moving within an ascending channel pattern. This structure tends to come before upward continuations, with the breakout level now at around $0.91.

In other words, if ADA clears that barrier, analysts expect the token to test anywhere between $1.01 and $1.10.

However, the support at $0.83 has become important for the asset. Any breaks below this price level would invalidate the bullish pattern and could drag ADA back towards the $0.70 price level.

Long positions have been stacked heavily between $0.83 and $0.85. A breakdown from here could also trigger a long squeeze. If this happens, it could add volatility to the market and worsen any downside moves.

On-Chain Growth Adds Long-Term Strength

Cardano’s network metrics show that the asset is still strong. This year alone, the blockchain processed over 112 million transactions. Average transaction fees stayed under $0.25. Cardano is one of the cheapest networks to use at scale.

Analysts believe the next major test for ADA is between $0.84 and $1.00. If the cryptocurrency successfully holds this price level, it would keep the bullishness intact. Also, a confirmed breakout above $1.20 could open the path to resistance around $1.50.

For now, ADA is trading at a turning point. The whales are accumulating for some reason, and on-chain signals show signs of an incoming push towards the upside. This all means that the ingredients for a bigger move are in place, despite ADA’s sluggishness.

Short-term volatility cannot be ignored, especially if leveraged longs start to unwind. Buyers may defend Cardano’s current price levels, and the cryptocurrency successfully breaks past $0.91. The chances of reclaiming $1 will improve by a wide margin.