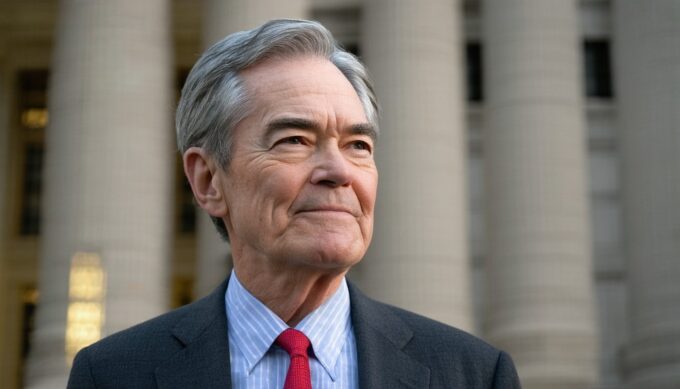

Federal Reserve Chair Jerome Powell presides over one of the most influential economic institutions in the world. Tasked with steering monetary policy for the United States, Powell’s decisions ripple across global markets, affecting everything from job growth to mortgage rates. Since his appointment in 2018, Powell has navigated an array of unprecedented challenges—most notably, a global pandemic, inflation spikes, and systematic financial uncertainty.

As the public face of the Federal Reserve Board, Powell’s communication style, transparency, and policy adjustments have become the focal point for economists, investors, and policymakers worldwide. His leadership reflects both continuity and change, marking a defining era in central banking.

Powell’s Policy Approach: Balancing Stability and Flexibility

Jerome Powell’s tenure as Fed chair stands out for its pragmatic, data-driven policy stance. Rather than adhering strictly to economic models or ideological frameworks, Powell has emphasized flexibility—responding to evolving economic conditions while maintaining the Federal Reserve’s dual mandate of price stability and maximum employment.

Navigating the Pandemic: Unprecedented Tools and Timelines

When COVID-19 paralyzed the global economy in early 2020, Powell and the Fed acted decisively:

- The federal funds rate was slashed to near zero.

- A broad array of emergency lending facilities was rolled out, echoing and expanding upon measures from the 2008 crisis.

- Massive asset purchases (quantitative easing) injected liquidity into financial markets.

These swift interventions stabilized critical U.S. credit markets and indirectly supported millions of businesses and households during the most uncertain months.

Transitioning From Crisis to Recovery

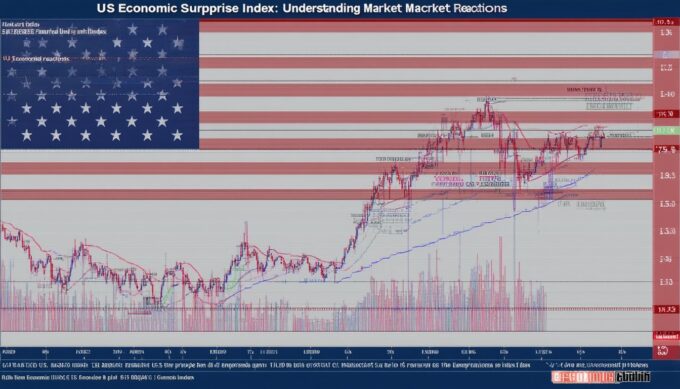

As pandemic restrictions eased and economic activity surged, Powell faced a new challenge: rapidly rising inflation. The consumer price index (CPI) rose faster than at any time in recent decades, putting the Fed’s credibility to the test. Powell recognized that some inflation drivers were transitory, such as supply chain disruptions, while others risked becoming entrenched if left unchecked.

In 2022 and 2023, the Fed responded with a series of aggressive rate hikes—its fastest tightening cycle in decades. This shift aimed to anchor inflation expectations without triggering a recession. Markets often responded with volatility, highlighting just how delicately the Fed’s actions are balanced.

“Our job is to ensure that inflation expectations remain anchored so that longer-term inflation does not become embedded in the American psyche,” Powell remarked at a major economic policy symposium.

Key Policy Decisions and Their Economic Impact

Analyzing Powell’s signature decisions reveals the complexity and high stakes of modern central banking.

Interest Rate Policy: Open-Eyed Vigilance

From near-zero rates during crisis to a rapid tightening cycle, Powell has steered the Fed’s benchmark rate with caution and assertiveness. Each policy meeting is closely watched, with statements parsed for clues about future moves. For borrowers and businesses, these decisions mean real changes:

- Mortgage rates surged past historic lows.

- Corporate borrowing costs increased.

- Financial assets, particularly stocks and bonds, showed heightened volatility.

The Fed’s anti-inflation stance has contributed to a noticeable cooling in sectors like housing. However, Powell has consistently signaled readiness to pivot if labor markets or financial instability become acute concerns.

Quantitative Easing and Its Aftermath

Quantitative easing (QE)—large-scale purchases of Treasury and mortgage-backed securities—became the Fed’s hallmark tool during crises. Powell expanded QE rapidly in 2020, nearly doubling the Fed’s balance sheet within months.

The policy reassured investors and lowered yields, but it also drew criticism for potentially fueling asset bubbles and wealth inequality. Allowing the balance sheet to shrink (“quantitative tightening”) is now being managed deliberately to avoid market disruptions.

Communication: Dispelling Uncertainty Through Transparency

Powell has made clear, plainspoken communication a priority. Press conferences, Congressional testimonies, and official statements aim to reduce market confusion—an evolution from the Fed’s historically opaque style.

Financial market participants rely on this transparency to factor Fed intentions into their investment decisions, reducing the risk of disruptive surprises.

Real-World Consequences: How Powell’s Fed Touches Daily Life

The economic impact of Powell’s policies is anything but abstract:

- Homebuyers regularly recalculate mortgage costs as Fed rate moves filter into banks’ lending rates.

- Small businesses revise growth plans as credit conditions tighten or loosen.

- Global investors and central banks adapt, as U.S. policy often sets a precedent for others.

Case in point: During the rapid tightening of 2022–2023, rising rates cooled real estate activity, prompted cautious expansion among U.S. companies, and spurred currency adjustments worldwide. The resulting economic slowdown, while controversial, contributed to slowing inflation without a dramatic unemployment spike—a testament to the fine line the Fed walks.

Critique and Future Challenges

While Powell receives praise for adaptability, criticism remains. Some economists argue that the Fed acted too late to rein in inflation, risking credibility damage. Others warn that rapid tightening could eventually tip the economy into recession. Nonetheless, Powell’s collaborative approach and willingness to adjust course stand in contrast to historical periods of rigid policy adherence.

Looking ahead, Powell confronts the challenge of guiding monetary policy through an era defined by technological disruption, climate risk, global deglobalization trends, and persistent questions about inequality. These new forces will test the limits of traditional tools.

Conclusion: Assessing Powell’s Legacy and the Path Forward

Jerome Powell’s leadership of the Federal Reserve has been marked by agility, transparency, and a readiness to deploy extraordinary measures in extraordinary times. His tenure illustrates the modern realities of central banking—where communication can be as powerful as policy, and where flexibility is essential for navigating volatility.

As Powell steers the U.S. economy through uncertainty, his decisions will continue to shape not just Wall Street forecasts but the lived experience of homeowners, workers, and consumers around the country. The ongoing task is clear: remain vigilant, respond to evolving risks, and maintain the Fed’s balance between stable prices and robust employment.

FAQs

What is the main role of Fed Chair Powell?

The Fed Chair sets the tone for U.S. monetary policy, guiding interest rates and financial regulations to support stable economic growth and control inflation. Powell also serves as a primary communicator to markets and policymakers.

How does Powell’s policy approach differ from past Fed chairs?

Powell emphasizes adaptability and transparency, responding to data rather than sticking rigidly to preset models. His term has seen faster, more flexible interventions during crises compared to some predecessors.

What impact have Powell’s interest rate decisions had on consumers?

Changes in the federal funds rate directly affect borrowing costs, including mortgages and credit cards. Under Powell, rates have moved quickly in response to economic shifts, influencing everything from home affordability to investment returns.

Why is Fed transparency important in Powell’s tenure?

Clear communication helps prevent market shocks and allows businesses to plan with better confidence. By outlining thinking behind decisions, Powell aims to reduce uncertainty for investors and the public.

Has the Fed under Powell been effective in fighting inflation?

The Fed under Powell has taken aggressive steps to contain inflation by raising rates at a pace not seen in decades. While the risk of recession remains debated, inflation has shown signs of cooling as a result of these actions.

Leave a comment