Introduction

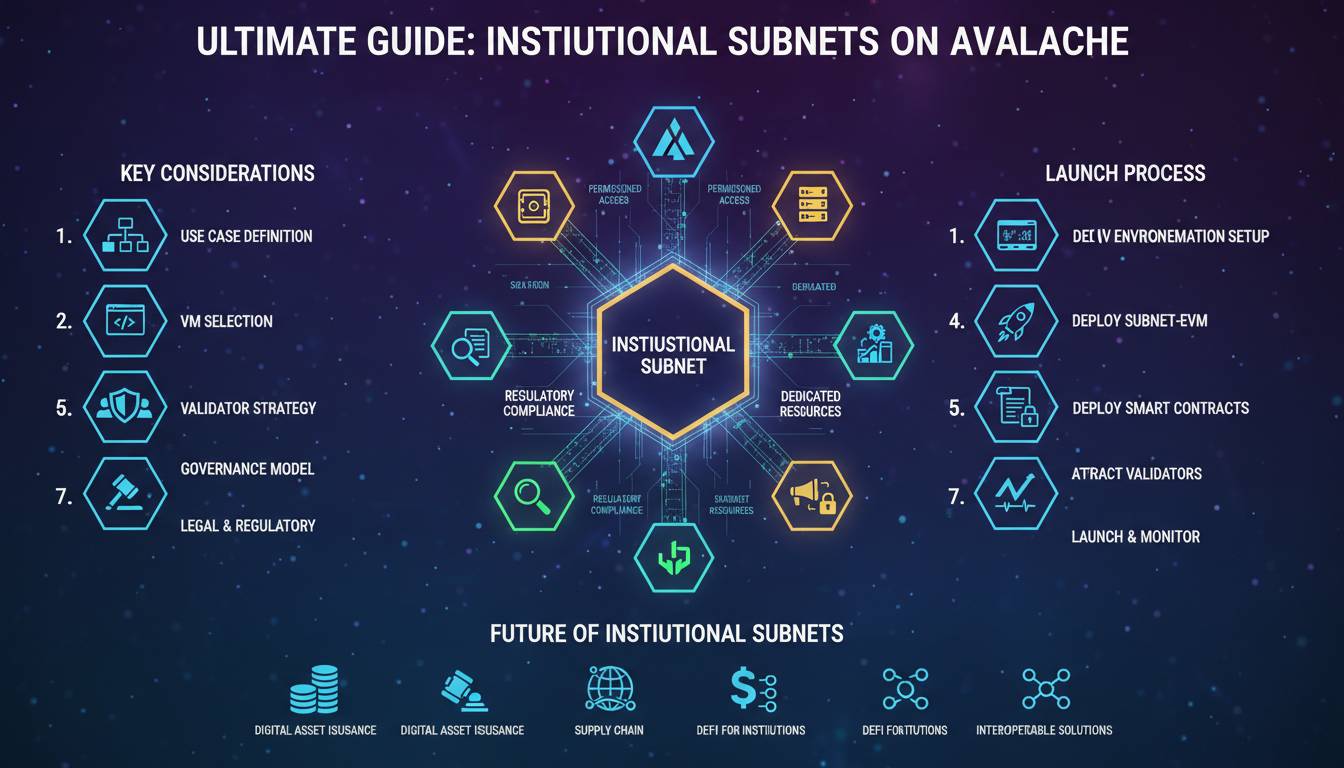

An important development is unfolding on the Avalanche network as it accelerates its appeal to global banks and institutional players. Flexible, permissioned subnets—termed Evergreen Subnets—are becoming a powerful bridge between regulated finance and blockchain infrastructure. These customizable chains offer KYC controls, bespoke transaction environments, and seamless interoperability. The result? A potential shift in how traditional financial entities trade, settle, and tokenize assets on-chain.

Why This Matters: Institutions Meet Subnets

At its core, this announcement signifies Avalanche’s strategic push into institutional finance. Evergreen Subnets enable banks and asset managers to deploy compliant, private chains that still benefit from Avalanche’s speed and interoperability—an attractive alternative to legacy permissioned systems like Corda or Hyperledger .

While public blockchains offer transparency and liquidity, institutions often prioritize privacy and control. Evergreen Subnets aim to deliver both. They incorporate permissioning (via wallet-based KYC/non-transferable tokens), customization options (e.g., custom gas tokens, validator sets), and maintain interoperability through Avalanche Warp Messaging (AWM) .

This architecture lets financial institutions experiment safely, scale efficiently, and comply with regulations—all while remaining part of the broader Avalanche ecosystem.

Institutional Use Cases and Early Adoption

Spruce Testnet: Banks Explore On-Chain Settlement

The Spruce Subnet testnet marked Avalanche’s institutional push. Participating firms—including T. Rowe Price, WisdomTree, Wellington Management, and Cumberland—used Spruce to trial FX and interest-rate swaps, simulate settlement pipelines, and explore asset tokenization under low-risk conditions . Onboarding required KYC-compliant wallets and allowlist governance—a clear nod to institutional guardrails .

Evergreen Subnets in Practice

Evergreen Subnets aren’t theoretical anymore. For instance:

-

IntainMarkets launched an asset-backed securities marketplace subnet for structured finance, strictly complying with U.S. regulation and involving U.S.-based validators .

-

Citi, WisdomTree, KKR, Apollo, BlackRock, and others have tested tokenized funds, FX, and corporate treasury use cases on permissioned subnets .

Expanding RWA Use

Avalanche’s institutional subnets bolster tokenized real-world asset (RWA) issuance. A $250 million deployment via Grove Finance and Janus Henderson illustrates this capacity, adding to a growing RWA ecosystem . By early 2026, Avalanche had surpassed $1.3 billion in RWA issuance, further cementing its institutional adoption momentum .

The Technical Backbone

Speed, Sovereignty, and Scalability

Avalanche’s subnet architecture delivers high performance and sovereignty. Subnets are independent yet secured by Avalanche’s Snow consensus. They offer sub-second finality, low transaction fees, and customizable governance—all key for institutional workflows .

Cross-Subnet Messaging

Interoperability remains crucial. Avalanche Warp Messaging (AWM) and Teleporter enable seamless messaging and asset transfers between subnets—essential for cohesive operations across multiple institutional chains .

Incentives and Ecosystem Growth

Technical upgrades like Avalanche 9000 reduced subnet creation costs by nearly 90%, boosting developer engagement . Incentive programs, such as Multiverse, have historically fueled subnet growth across DeFi and enterprise use cases .

Market Impact and Trends

Avalanche is positioning itself as the institutional-grade subnet layer of Web3:

-

It reports over $12 billion in TVL across gaming, DeFi, and institutional use cases, with 70+ active subnets by late 2025 .

-

On-chain activity from institutions—especially via RWAs—is on a rapid upswing. In 2025, Avalanche’s RWA TVL grew 232% year-over-year to over $1.3 billion .

-

Compared to Ethereum’s general-purpose ecosystem, Avalanche differentiates with targeted compliance, sovereignty, and customizability—factors critical for institutional finance .

What’s Next for Institutions on Avalanche

Financial markets will likely monitor:

-

Expansion of tokenized credit and real estate products across dedicated subnets.

-

Rollout of subnet solutions for settlements, treasury operations, and tokenized funds.

-

Upgrades improving cross-subnet liquidity, scalability, and regulatory tooling.

“We see Evergreen Subnet architecture as essential for scalable, compliant on-chain institutional finance,” said Avalanche executives. This underscores a shift where networks become modular building blocks rather than monolithic platforms.

Conclusion

Avalanche’s Evergreen Subnets are reshaping how institutions engage with blockchain. They deliver a rare combination of compliance, performance, and interoperability. From Spruce pilot trials with banks to multi-billion-dollar RWA models, institutions are increasingly treating Avalanche as a viable infrastructure layer, not just an alternative smart contract platform.

As regulations crystallize and asset tokenization matures, subnets could become the default architecture for bridging traditional financial systems with digital ledgers. Expect more launches, deeper cooperation, and a shift toward modular, sovereign chains tailored to institutional needs.

Leave a comment