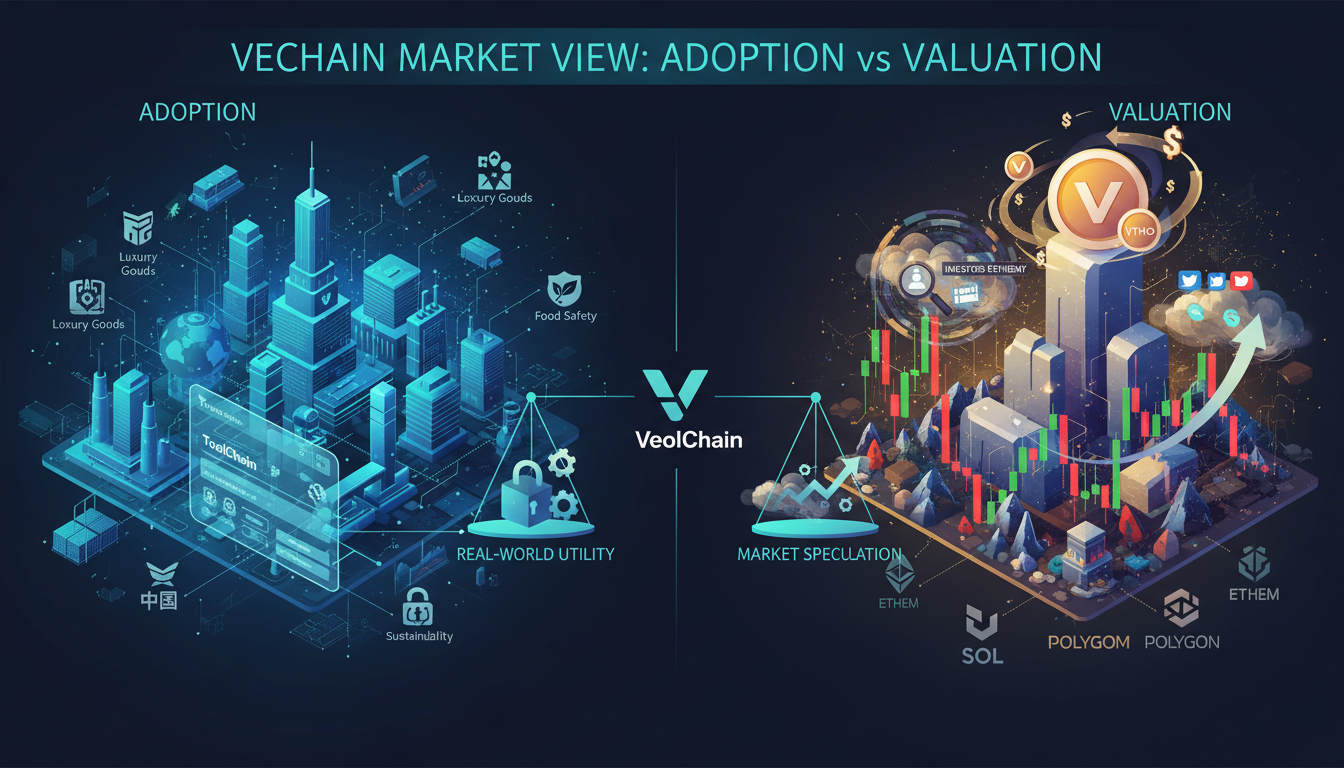

VeChain’s market strength today lies more in tangible adoption—through enterprise deals, sustainability apps, and real-world product tracking—than in speculative valuation. Its usage metrics and ecosystem utility have surged, even as token prices lag. Let’s dig into why real adoption doesn’t always equate to market valuation—and why that matters for long-term outlook.

Why Adoption Isn’t Always Reflected in Market Value

VeChain’s network activity tells one story. Its VET market cap tumbled over 50% in Q4 2025, dropping below $900 million, while VTHO saw a similar decline . Yet behind the scenes, user engagement and enterprise adoption grew markedly.

- Network adoption: VeChain’s VeBetter platform amassed over 5 million users and processed 40+ million sustainable actions—like recycling or energy savings—while enabling millions of on-chain transactions .

- Developer growth: Q3 2025 saw daily active addresses jump 85% to over 60,000 and daily transactions rise 32%, signaling renewed momentum .

- Enterprise use: Brands like Walmart China, BMW, and Rekord now deploy VeChain for digital product passports, supply chain traceability, and automotive authentication .

So the network is busy and growing—just not reflected on price charts. Why? Because speculative valuation often lags when real demand shifts—from hype-driven traders to real-world utility using apps and regulatory infrastructure.

Deep Dive: Metrics Showing Real Adoption

VeBetter & X-to-Earn vs Traditional Metrics

VeChain’s X-to-Earn model, via VeBetter, rewards users for sustainable actions through gamified apps like Mugshot and Greencart. The results? Millions of users, tens of millions of actions tokenized, and environmental impact at scale .

This is adoption in action—not just blockchain usage, but real behavior change. These apps operate outside the “crypto bubble,” reaching everyday users who don’t care about tokens—they just want impact.

Developer & Transactions Growth

After launching the Galactica mainnet in mid-2025, VeChain’s network activity surged. Daily active addresses and transactions climbed sharply, reversing earlier declines and signaling real engagement .

This uptick points to developer adoption and dApp usage—not speculative trading.

Institutional & Regulatory Adoption

VeChain has aligned itself with EU regulatory frameworks like MiCAR and ESPR, launching compliant tokens and infrastructure ahead of enforcement. Partnerships with Keyrock, BitGo, Franklin Templeton, and brands like Walmart China and Lululemon China reinforce institutional interest .

It’s a shift from being a “crypto project” to a trusted enterprise-grade blockchain backbone.

Valuation Disconnect: Why Prices Lag Behind Adoption

When speculation fades—especially during bear markets—token prices often fall faster than fundamentals. VeChain is a textbook case.

- Its market cap slid 52% in Q4 2025 even as addresses and app usage surged .

- Meanwhile, institutional wallets steadily accumulated VET ahead of cross-chain upgrades—reflecting long-term positioning rather than short-term trading .

Investors focused on real-world utility may take time to translate use cases into token demand. But the foundation for sustainable growth is being laid.

Roadmap Highlights: Bridging Adoption to Valuation

Renaissance Upgrades

VeChain’s technical overhaul continues with three key phases:

- Galactica (mid‑2025): Introduced EIP‑1559-style fee burns and EVM compatibility .

- Hayabusa (late‑2025): Shifted to DPoS, slashed VTHO inflation, and limited rewards to active stakers via StarGate .

- Intergalactic/Interstellar (2026): Targets cross-chain interoperability and full EVM parity, easing developer onboarding .

VeWorld: User Onboarding Simplified

VeWorld is VeChain’s super-app self-custody wallet. It offers gas abstraction, social login, and easy access to sustainability apps, staking, and cross-chain features. The goal: onboard millions of mainstream users who don’t know it’s blockchain .

Institutional-Grade Infrastructure

VeChain is building compliant, scalable infrastructure with partners like PwC, DNV, Rekord, and more—tied directly to EU sustainability mandates. That adds legitimacy—and potential long-term token demand—when use cases go live .

Expert Take

“VeChain’s value now derives from recurring enterprise utility rather than speculation. Regulatory alignment and network effects form a durable investment thesis.”

This perspective captures the shift: VeChain isn’t chasing pumps—it’s building systems companies rely on.

Conclusion

VeChain’s adoption is climbing fast. Millions of users and transactions, strong developer activity, sustainability apps, and institutional partnerships—all show real-world traction. Yet valuation trails behind. This gap isn’t a bug—it’s a sign of foundational growth rather than hype.

The Renaissance upgrades, VeWorld wallet, and regulatory alignment are fine-tuning the system for mainstream demand. For investors, this means looking beyond price charts to underlying adoption—and to 2026, when real use may finally reflect in value.

FAQs

What makes VeBetter different from other blockchain apps?

VeBetter rewards daily sustainable actions, not speculative trades. It targets mainstream users via gamified, real‑world utility rather than blockchain complexity.

Why hasn’t VeChain’s price reflected its ecosystem growth?

Speculative markets often lag real utility. As adoption shifts from traders to enterprises and users, token demand is more stable—and slower to rise.

How does the Hayabusa upgrade improve VeChain’s economic model?

Hayabusa moved VeChain to DPoS, reduced VTHO inflation by half, and directed rewards only to active stakers via StarGate, increasing token scarcity and alignment .

What’s the role of the VeWorld wallet?

VeWorld is a user-friendly gateway to VeChain. With social login and gas abstraction, it brings mainstream users into apps and staking without crypto jargon .

Why are institutional partnerships important for VeChain?

They anchor VeChain in enterprise use-cases like supply chain tracking and regulatory compliance. These provide recurring real-world demand—not speculative flows .

What is Intergalactic/Interstellar and why does it matter?

It’s VeChain’s final upgrade phase targeting cross‑chain interoperability and full EVM compatibility. By easing developer migration from Ethereum, it could unlock new app ecosystems .

Leave a comment