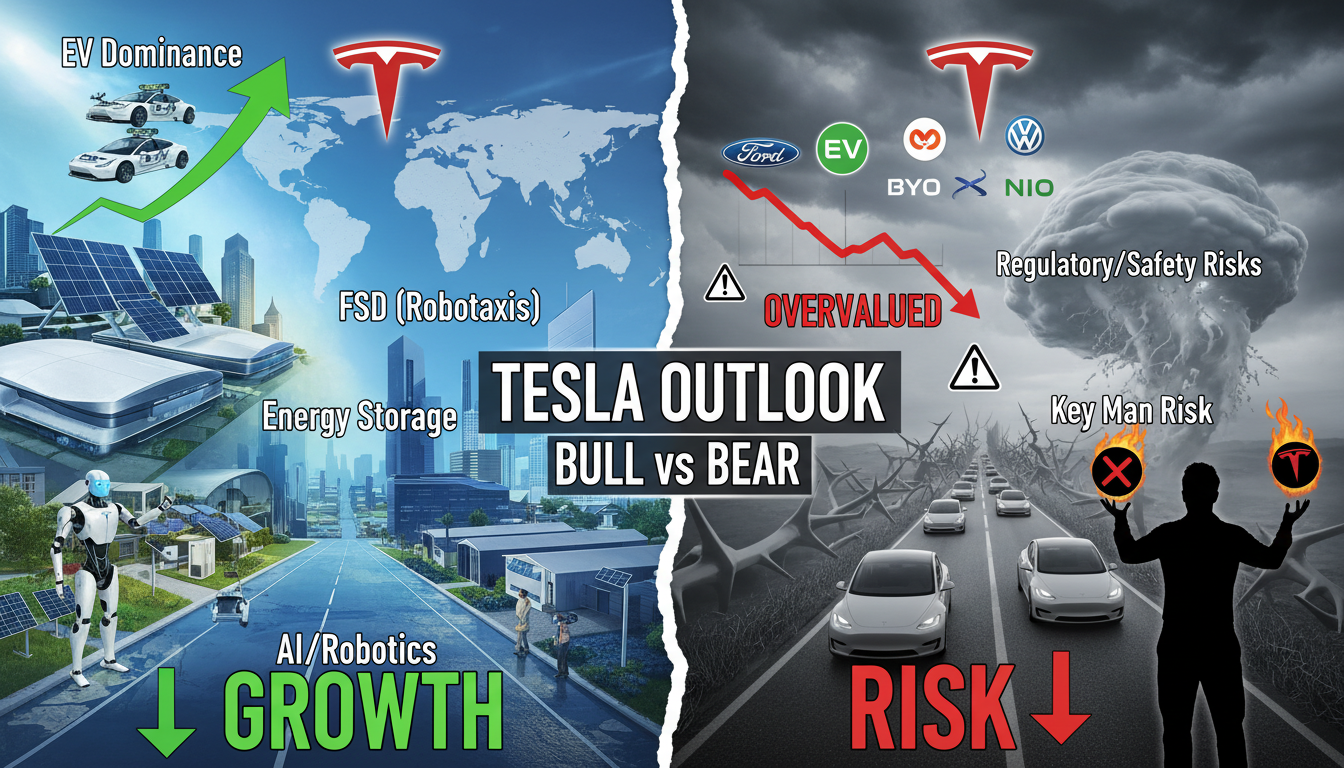

The long-term outlook for Tesla in 2025 hinges on two diverging threads: in the bull case, Tesla succeeds with its robotaxi network, Optimus robots and energy expansion, dramatically reshaping its business model; in the bear case, delays in autonomy, shrinking margins, and competitive pressure leave Tesla struggling as just another automaker.

Bull Case: The Future as an AI‑Powered Growth Engine

Tesla’s bullish narrative rests on several key pillars working in tandem:

Robotaxi Scaling and Recurring Revenue

Tesla launched its Robotaxi service in Austin in June 2025 with FSD-equipped vehicles and safety monitors, marking the start of ride-hailing ambitions . If Tesla manages to scale unsupervised robotaxi operations by 2026, it could evolve from selling cars into providing recurring “Transport-as-a-Service” revenue .

Optimus Robots as a New Frontier

Beyond vehicles, Tesla’s Optimus humanoid robot could redefine its revenue streams. Bulls envision mass production and multi-industry deployment, potentially transforming it into a major growth driver .

Energy Storage Strength

Tesla’s Megapack and Powerwall segment showed robust performance in late 2025, driven by data center demand, with projections suggesting doubling revenues to about $18 billion by 2026 .

Vertical Integration and Cost Advantage

Tesla’s strength lies in controlling the full stack—from batteries to AI models. This vertical model gives it a competitive cost advantage, especially in robotics and autonomy .

Valuation Potential in Bull Case

ARK’s Monte Carlo model projects Tesla’s stock at a base value of $4,600 per share in 2026, with a bull case at $5,800 . By 2029, ARK places the bull-case price at about $3,100 per share .

“The car is just a Trojan horse. The real value is in the high‑margin AI stack built on top of the fleet.”

Bear Case: Execution Risks and Market Pressures

On the flip side, pessimism stems from tangible challenges Tesla faces:

Autonomy Setbacks

Regulatory hurdles may delay full deployment of Level 4/5 autonomy. If robotaxi monetization doesn’t materialize, the AI-driven growth narrative falters .

Shrinking EV Margins

Automotive revenue is under pressure, especially with EV tax credits disappearing. Global competition—particularly from China and Europe—further compresses margins and deliveries .

Valuation Disconnect

Critics like Michael Burry warn Tesla is overvalued, trading at nearly 294x trailing earnings. Dilution from stock-based comp and Musk’s enormous incentive package add weight to the bear thesis .

Analyst Downgrades and Cutbacks

Morgan Stanley downgraded Tesla in December 2025 due to valuation concerns and softened delivery forecasts . Analysts also recently trimmed profit targets, anticipating a continued slide in earnings driven by heavy CapEx and reduced model variety .

Brand Risks and Public Backlash

Tesla has attracted protests and vandalism tied to Elon Musk’s political profile. These actions, labeled “domestic terrorism” by the FBI, risk damaging brand perception and consumer sentiment .

Comparative Forecast Table (2025–2026)

| Scenario | Key Drivers | Risks | Share Price Outlook |

|——————|—————————————————–|————————————————–|—————————–|

| Bull | Robotaxis, Optimus, energy expansion, AI stack | Execution delays, stiff expansion demands | Up to $5,800 (2026)–$3,100 (2029) |

| Bear | Automotive slump, regulation, valuation shock | No robotaxi income, high dilution | Down to $2,900 (2026) or less |

(Based on ARK projections and synthesis of analyst commentary) .

Key Catalysts and Watchpoints (2025–2026)

-

Robotaxi rollout beyond Austin

— Expansion into new markets and removal of safety monitors will signal maturity. -

Optimus production ramp

— Early industrial usage or external deployments could build confidence. -

Energy margin resilience

— Sustained growth in Megapack/Powerwall revenue will both diversify and stabilize earnings. -

Capital discipline vs ambition

— Tesla’s ability to manage $20B in planned CapEx and maintain profitability will be crucial . -

Regulatory clarity on autonomy

— Approval timelines and legal rulings will determine robotaxi feasibility.

Conclusion

Tesla’s 2025 long-term view is bifurcated. In the bull case, Tesla morphs into a tech titan—robo‑taxis, humanoid robots, and energy systems drive exceptional valuation. In the bear case, regulatory delays, macro pressures, and overvaluation leave Tesla treading water in a cutthroat EV landscape.

The defining line between these outcomes? Execution. If Tesla can make robotaxis reliable, get Optimus to market, and grow its energy business, the bull case could become reality. If not, traditional automakers and AI skeptics may have the upper hand.

FAQs

Q: What’s the earliest robotaxi launch outside Austin?

By mid‑2025, Tesla aimed for a dozen U.S. cities, but actual rollout remains limited. Expansion depends heavily on regulatory approval.

Q: How significant is the Optimus segment for Tesla’s valuation?

Very—bulls view it as a future revenue juggernaut, potentially surpassing vehicle sales, but it’s highly unproven at scale right now.

Q: Could Tesla’s energy business save the company if car sales falter?

Absolutely. Strong margins in storage and grid projects can stabilize earnings and diversify revenue, cushioning automotive weakness.

Q: How realistic are ARK’s $4,600–$5,800 per share targets?

They’re optimistic outliers. While possible, those targets rely on flawless execution of AI and robotics, which carries high risk.

Q: What regulatory hurdles could delay Tesla’s autonomy strategy?

Safety audits, federal and state approvals, and liability frameworks for robotaxis could significantly slow rollouts.

Q: Is Tesla’s stock dilution a concern long-term?

Yes. Stock-based compensation and Musk’s compensation plan may dilute shareholders unless offset by strong growth.

Leave a comment