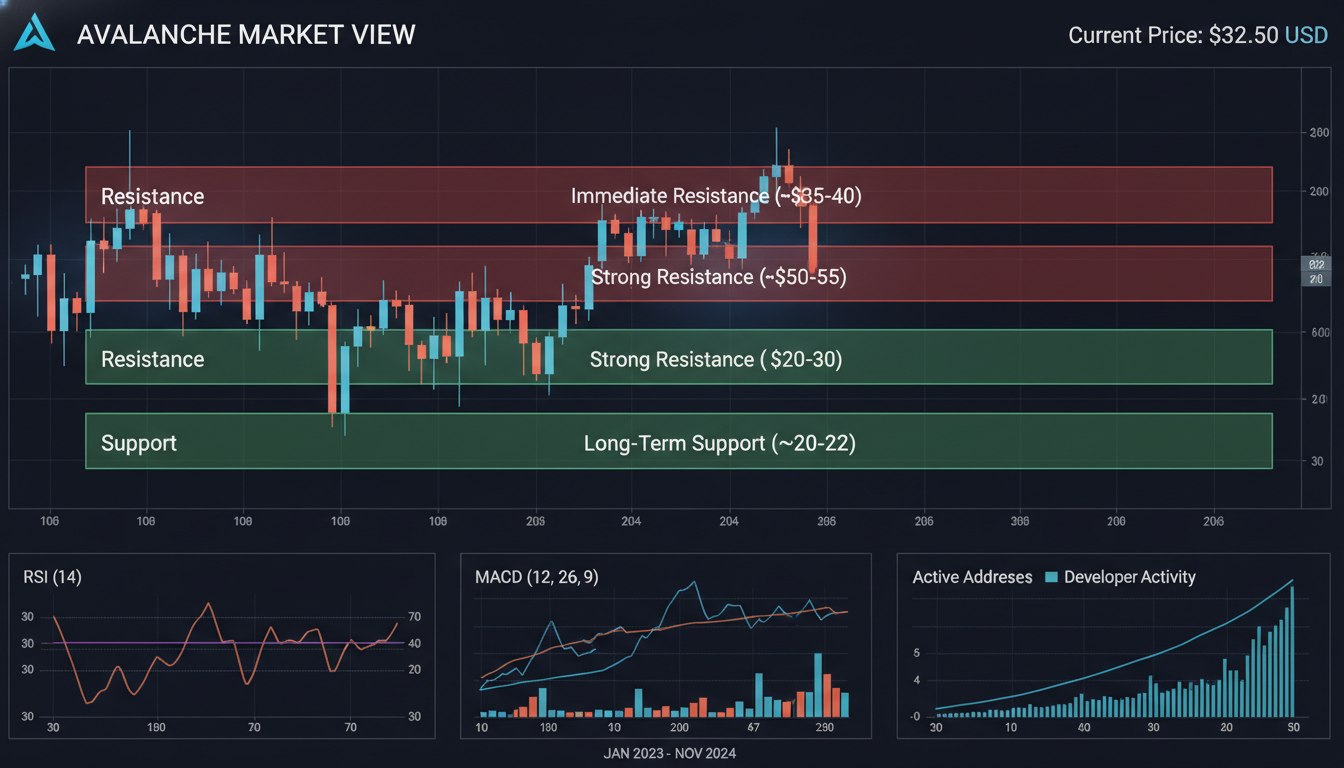

Avalanche (AVAX) is currently navigating a pivotal phase where key price levels are shaping its next move. Traders and investors should monitor major resistance around $9.62, $10–$11, and $27–$28, while important support zones lie at $9.24, $9.00–$9.16, and $20–$22. These levels may dictate whether AVAX breaks out or continues consolidating.

Current Price Landscape & Near-Term Dynamics

Avalanche has rebounded roughly 12% in a day, reaching about $9.28, lifted by a macro-driven rebound in broader risk assets and positive sentiment around institutional interest and strong on-chain activity .

The $9.24 zone held as a critical Fibonacci support (78.6% retracement). If AVAX manages to close daily price above $9.62—the 7-day SMA—it could mark a short-term upside shift . But a drop below $9 could open the path back toward the recent low near $7.70 .

Broader Technical Backdrop: Indicators & Trends

According to Investing.com, the technical picture on February 7, 2026 shows a “Buy” summary, with more moving averages and indicators on the bullish side than bearish. The RSI stands at 54.5 (neutral) while MACD signals a buy .

TipRanks, in contrast, gives AVAX a “Sell” stamp. It’s trading well below its moving averages—especially the 20-, 50-, 100-, and 200-day—which are all suggesting bearish pressure. RSI remains neutral, but momentum indicators like CCI lean bullish .

CoinLore echoes the bearish trend, noting the price is under both the 50- and 200-day EMAs. RSI is deeply oversold (~27), suggesting a potential for relief bounces—but volatility is high .

Key Support Levels to Watch

$9.24 – Fibonacci Support

Recent pullback found a hold here. If AVAX holds above, risk-reward improves .

$9.00–$9.16 – CoinStats Zones

This area has acted as a stable zone since 2021 and offers significant downside buffer .

$20–$22 – Medium-Term Base

OKX highlights this as a major support range when AVAX was trading higher in the $23–$25 territory.

Key Resistance Zones to Monitor

$9.62 – 7‑Day SMA

A close above could validate the recent bounce and suggest a short-term trend shift .

$10–$11 – CoinStats & TipRanks

Resistance at $10.13–$10.73 and $11.59–$11.43 may act as next hurdles for a recovery attempt .

$27–$28 – OKX Top Resistance

Breaking above this zone may push AVAX toward $30+, though that’s a more bullish scenario .

Contextual Backdrop: Broader Ecosystem & Sentiment

Institutional interest remains a compelling backdrop. OKX reports Avalanche’s ecosystem growth through integrations like Visa’s stablecoin use and FIFA’s NFT ticketing, plus surge in TVL (from ~$1.49B to ~$1.93B) and daily trading volumes past $785M .

Earlier, AVAX had a strategic inflection near $15.27 in late 2025, with a breakout potentially reaching $18 if momentum held. That analysis infused the view that technical and fundamental drivers were aligning .

“What to Do?” — Strategic Takeaways

“Holding the $9.24 Fibonacci support now could be the difference between relief bounce and deeper slide. Only a strong close above $9.62 might shift short-term bias.”

— Market Insight

- Short‑term traders should watch for a daily close above $9.62. If that happens, consider scaling in with tight stops.

- More cautious players may want to wait for a confirmed break above the $10–$11 resistance with volume.

- Long-term bulls could see the consolidation as a buying zone—but need to acknowledge that broader indicators still tilt bearish.

Conclusion

Avalanche is at an inflection point. Key support at $9.24 is holding for now. A break above $9.62 and into the $10–$11 region could offer some upside. Yet broader trend indicators (moving averages, EMAs) still reflect bearish pressure. Watch price action closely and align entry with real confirmation of momentum.

FAQs

What’s the most immediate resistance for AVAX right now?

The 7‑day SMA at $9.62 is the near-term resistance level to watch. A daily close above it could signal short-term strength .

Where is AVAX’s main support zone?

Primary support lies at $9.24 (Fibonacci 78.6% retracement). Below that, the $9–$9.16 zone and broader $20–$22 area may offer deeper support .

Are the technical indicators bullish or bearish?

Mixed. Investing.com shows a bullish lean overall. TipRanks and CoinLore lean bearish due to price below long‑term moving averages and oversold signals .

Could AVAX make a deeper bounce beyond current levels?

Yes. If AVAX clears $27–$28 resistance—amid institutional catalysts—it could target $30‑plus zones. But that requires sustained momentum and broader crypto strength .

What risks remain in play?

Macro volatility and AVAX’s high beta with broader market pose significant risk. If the broader crypto sell‑off resumes, AVAX may slip below $9 and challenge recent lows.

Word Count: ~920 words.

Leave a comment