Breaking crypto news: Zcash has recently seen major developments—from breakthrough upgrades and institutional backing to internal turmoil and future-facing innovations—that are reshaping its trajectory. Here’s what’s happening with Zcash now and what’s on the horizon for this privacy-focused cryptocurrency.

Recent Breakthroughs Elevating Zcash’s Profile

Infrastructure Modernization: Zebra Transition & NU6.1 Activation

Zcash is undergoing a substantial tech revamp. In late 2025, the Zebra 3.1.0 upgrade replaced the old zcashd node software with a more efficient Rust-based implementation. It adds Docker support for ARM64 and AMD64 systems and includes a mempool dust filter to reduce spam and improve operational resilience—critical for developers and node operators.

Additionally, the NU6.1 network upgrade went live in November 2025, rolling out enhancements for shielded transactions via ZIPs 317 and 224. Fees were slashed by around 30%, and shielded pool participation surged to roughly 28–30% of the circulating supply—signaling stronger privacy adoption.

Institutional Momentum & ETF Moves

Institutional interest in Zcash is accelerating. Grayscale filed for a Zcash ETF, with the Zcash Trust managing over $150 million in assets; Bitwise followed suit, reinforcing confidence. Meanwhile, Cypherpunk Technologies has strategically accumulated ZEC—now over 1.7% of the circulating supply (about $29M worth)—on a long-term privacy infrastructure thesis.

On-chain data backs this up: top holders have increased their ZEC positions by around 48% over 30 days, even as the price dipped—suggesting accumulation, not capitulation.

Pricing Highs and Volatility Swings

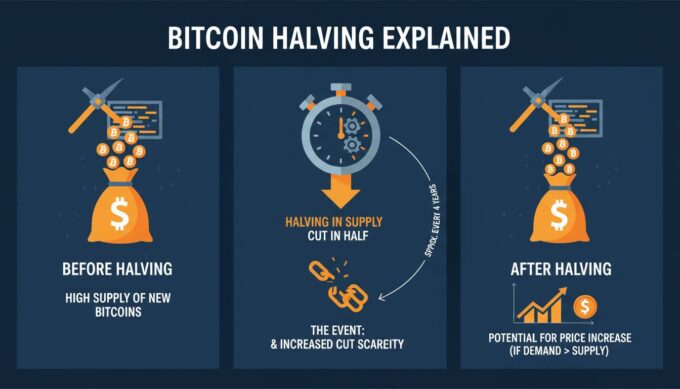

Zcash has had a wild ride. In 2025, it surged over 800%, peaking above $600. A halving event in November triggered massive volatility—a historic 1,172% spike followed by a 96% correction—highlighting ZEC’s speculative nature amid scarcity narratives. Earlier in October, the coin achieved its highest privacy-coin market cap, overtaking Monero and reaching a price near $388.

Turmoil Behind the Scenes: Developer Exodus

In January 2026, a dramatic pivot occurred: the entire Electric Coin Company (ECC) development team resigned due to governance conflicts with Zcash’s nonprofit oversight. They launched a new startup to develop cashZ, a privacy-first wallet built on the Zashi codebase, while the Zcash Foundation stressed that the protocol remains decentralized and unaffected.

This split introduces uncertainty around governance, though continuity of development is maintained through the new team—a mixed signal for market sentiment.

What’s Next? Roadmap Innovations and Strategic Momentum

Layer-2 Ambitions: Ztarknet Devnet in Q1 2026

Zcash is poised for programmability with Ztarknet, a Starknet-inspired L2 rollup slated for early 2026. It enables private smart contracts via Circle-STARK proofs while preserving baseline privacy—a neutral-to-bullish catalyst for DeFi on ZEC.

Wallet Enhancements: Zashi 2.0 & Mobile Expansion

The Zashi 2.0 roadmap is ambitious: it introduces ephemeral addresses to reduce linkability, automatic transparent address rotation, better hardware wallet support, and improved user experience. Complementing this, upcoming wallet features include vault mode, emergency lock triggers, offline transaction signing, mobile app releases (iOS/Android), yield integrations, and local-node modes.

Privacy & Consensus: Z3 Stack and FROST Collaboration

Zcash’s 2026 strategy includes fully adopting Zebra as the consensus layer (i.e., retiring zcashd), along with rollout of the Z3 stack—composed of Zebra, Zaino, and Zallet—to boost performance, scalability, and privacy. Advanced features like FROST multi-party shielded signing are expected, alongside ZIP-312 for streamlined implementation.

Quantum Resilience by March 2026

The community roadmap includes “Quantum Recoverability.” By March 2026, Zcash aims to support systems to detect and quarantine quantum attacks to preserve network integrity—a thoughtful, forward-looking security layer.

Supply Dynamics: NU7 Enhancements for Scarcity

Future upgrades under NU7 could tighten supply dynamics significantly through mechanisms like shielded asset burning (ZIP 226), sustainable emission models (ZIPs 233–234), and transaction fee burns (ZIP 235), further reinforcing scarcity.

Interpreting the Landscape: Risks and Catalysts

- Upsides: institutional buy-in, modernized infrastructure, layering of DeFi capabilities, and strong privacy adoption create compelling tailwinds.

- Risks: governance upheaval and on-chain volatility support a cautious view in the near-term, though technical foundations remain strong.

- Supply-tightening mechanisms and shielded pool growth may compound upside, but only if market sentiment supports gradual adoption.

“Prioritizing shielded transactions and modern infrastructure puts Zcash squarely in the privacy-crypto spotlight—but staying aligned under new leadership is the real test.” —industry analyst

Conclusion

Zcash is navigating a critical pivot point. With infrastructure modernization, expanding institutional trust, a bold roadmap of programmability, and advances in privacy and supply mechanics, it’s positioning itself for deeper adoption in 2026. Yet internal governance shifts and volatile sentiment temper that optimism. Ultimately, Zcash’s evolution beyond a niche privacy coin into a programmable, institutional-ready network will define its next chapter.

FAQs

What triggered the recent Zcash rally?

The 2025 halving, infrastructure upgrades like Zebra 3.1 and NU6.1, and institutional moves—Grayscale ETF filings and Cypherpunk accumulation—were key drivers.

How did the developer exodus affect Zcash?

While abrupt, the transition preserved continuity via cashZ and Zashi codebase reuse; the Foundation reaffirmed decentralization, aiming to steady investor sentiment.

What is Ztarknet and why does it matter?

Ztarknet is a Layer‑2 rollup launching in 2026 that enables private smart contracts on Zcash using STARK proofs, expanding utility toward DeFi and programmable use cases.

How will supply changes affect ZEC’s value?

NU7 proposals aim to reduce available ZEC via burns and emission smoothing, while increasingly shielded supply shrinks tradable amounts—potentially supporting scarcity-driven price appreciation.

Is Zcash prepared for the post‑quantum era?

Yes—”Quantum Recoverability” features are expected by March 2026, enabling detection and response to quantum threats without overhauling the protocol.

What’s the overall outlook for Zcash in 2026?

If infrastructure, institutional backing, and roadmap execution hold, Zcash could transition from a niche privacy play to a broader privacy infrastructure layer—with caveats around governance and market volatility.

Leave a comment